The Lower Drug Costs Now Act (H.R. 3) is being voted in the US Congress. It plans to forcefully lower some medical drug prices in the United States, down to levels practiced in Australia, Canada, France, Germany, Japan and the United Kingdom.

This legislation sparked a backlash across the American pharma industry, including an interesting reaction from Bruce Booth, a Venture Capitalist popular on social medias:

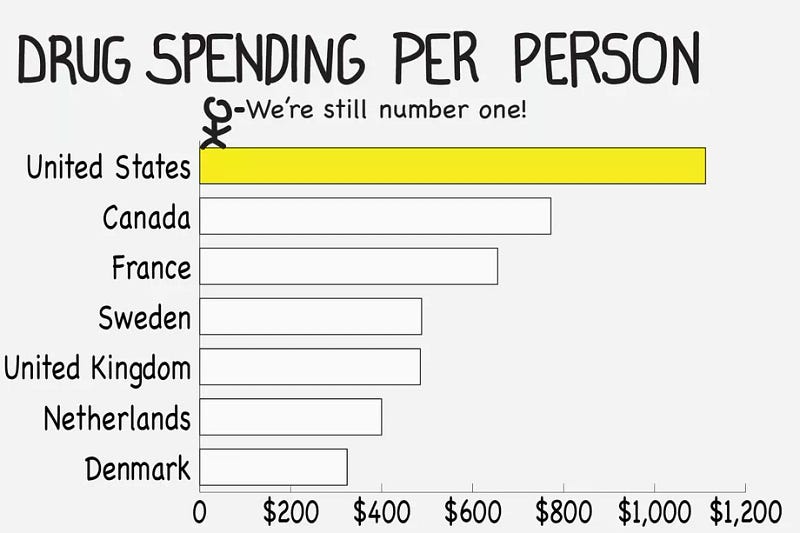

In a detailed blog post, Bruce argues against price control, because he says American overspending is necessary to keep global pharma R&D sustainable. According to him, price regulation will not only cut infamous costs that keep polluting American pharma (insurers, marketing, executives salaries, PBMs, Washington lobbyists…), it will also ruin R&D as a collateral damage.

As an early-stage investor, Bruce explains how late-stage investors are buying his R&D assets because they expect big profits in the American market. In turn, those late-stage investors bring pharma innovations to patients, after expensive clinical trials. Drug development is a lengthy process, and when investing, Bruce has no visibility on potential returns: instead, he simply assesses medical need, and then hopes for big money to follow 5–10 years later.

Conservatism about R&D is not an option

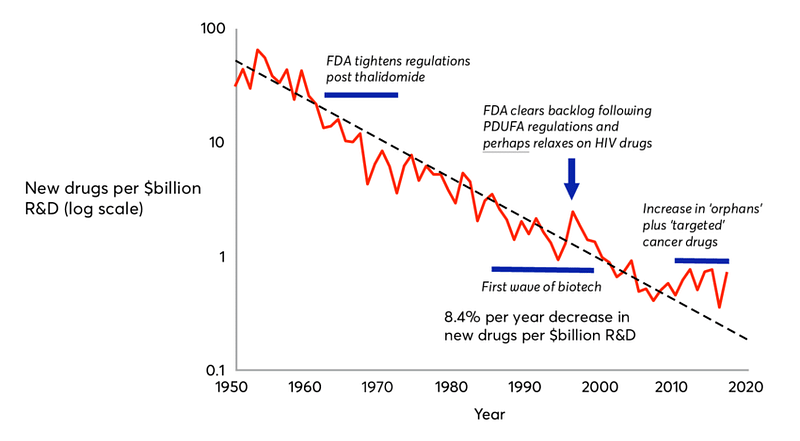

Bruce raises legitimate concerns, but they should not imply this conservative posture prevalent in the pharma industry, a conservatism underlying most of the opposition to this price reform. As Bruce explained, the existing deal in Pharma R&D is far from ideal: innovation is plagued with high risks, high costs, and lengthy time to market. This old drug deal, inherited from the 1950’s, leads to the Eroom’s law of exponential decline of pharma innovation, of which high prices are symptomatic.

This price reform should be taken as an opportunity to start a new drug deal. I am disappointed to see all those VCs and entrepreneurs, who are supposed to be hungry for technological risks, suddenly become reluctant to take any policy risk about the R&D framework itself, at a moment when intellectual courage and creativity are much needed.

Patients only pay twice

With the current deal, American patients only pay at the two distant extremities of the pipeline: at the end, when they purchase drugs (out-of-pocket expenses and medical insurance), and at the beginning of the pipeline, when they pay taxes funding the National Institutes of Health (NIH), which initiate scientific research leading to new drugs 15 years later. Patients almost pay nothing in-between, deserting a wide “valley of death” ruled by private investors in drug development, like Bruce.

I think a new public R&D policy should help private investments in the middle of the pipeline, in order to shorten investment cycles, and sustain this industry in chronic crisis.

The Pelosi bill already makes one tiny step in the right direction: it invests an additional $10 billion over 10 years back into the NIH (for its middle pipeline and translational program, the 21st Century Cures Act), from the $345 billion over 10 years savings for Medicare, brought by lower drug prices. That’s very little, less than 3% reinvested in research. This Pelosi trick should be the point where the debate focuses on. I think a progressive policy with a conservative budget is not going to work. There’s no free lunch.

The NIH is not granted

Bruce Booth and many other critics are surprisingly silent about this NIH side of the Pelosi bill. Instead, they whane about supposedly irrational politicians (few critics however here and here). They take NIH scientific output for granted, at a time when Trump threatens to slash NIH budget by $5 billion. I am asking how Bruce will explain the importance of NIH funding to the tens of millions of Americans who can’t afford drugs from the US, and who need to purchase them online from Canada, or offline from Mexican pharmacies at the border.

For-profit biotechs around the world freeride on NIH research. Personally, as an entrepreneur in AI for pharma, I am an avid consumer of NIH free databases, like the Cancer Genome Atlas (2.5 Petabytes of free data), which costed $375 Million to American taxpayers. They considerably lower the costs for bootstrapping businesses (so that I don’t need to chase VCs like Bruce Booth for launching my own, see: www.melwy.com).

Democratize Pharma R&D

Nevertheless, I don’t think the NIH should be the only research player, even if it was boosted with $345 Billion instead of the $10 Billion included in the Pelosi bill. The remaining 97% of savings from lower drug prices ($335 Billion) should instead be spent on bottom-up approaches. Big pharma bureaucracy should not be replaced by big government bureaucracy. Moreover, democratizing pharma R&D involvement will also lead the general population to better understand biotech costs and accept their high prices.

Initiatives in this direction already exist, and should be promoted further. They revolve around ideas of delinkage between drug prices and R&D costs.

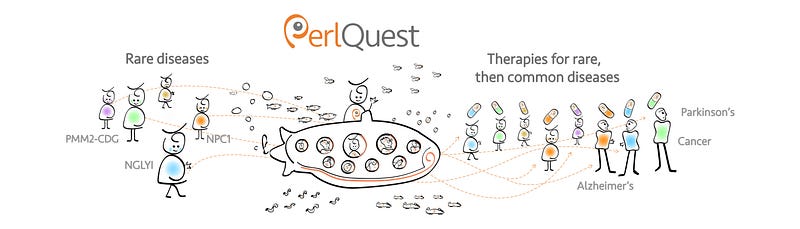

Patients partnerships

For example, in South San Francisco (next to Nancy Pelosi’s district), a small biotech called Perlara was funding rare diseases projects directly by patients and families, who in exchange received joint ownership of the resulting data and inventions. This method was an attempt to democratize venture philanthropy and investment. Unfortunately, Perlara ran out of funding in early 2019, but I keep wondering what would have happened if patients’ investments had been matched with government subsidies.

Equity crowdfunding

Equity crowdfunding is gaining traction in American biotech, since the JOBS Act in 2012. The European Union also has a dedicated crowdfunding platform for health investments, EIT Health. This trend can be amplified by public co-investments.

Crowdfunding can also help increasing investors bandwidth. Accredited VCs receive more pitches than they can handle. Like Bruce’s firm Atlas Venture, most VCs don’t even put an email, or contact form, on their website, to avoid being cold approached by innovative entrepreneurs. They prefer warm intros by their friends and network, or bump in at their favorite coffee shops in the Silicon Valley or Kendall Square. Some Venture Capitalists even write sophisticated tutorials about how to approach them.

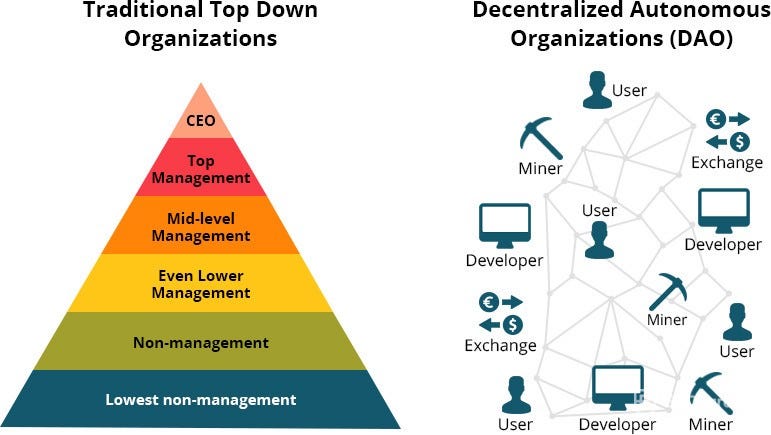

Blockchain

Emerging technologies like crypto-currencies, blockchain and Decentralized Autonomous Organizations can facilitate democratization of biotech investment. Successes of the Bitcoin and ICOs show there’s a global demand for tech investment, which should no longer remain a privilege of the few. Government subsidies can accelerate this movement, and incentivize transparency in this hard-to-regulate environment.

I am currently running such an experiment in AI for drug discovery projects, where participants can earn prizes, paid in a virtual currency, if they succeed at some research milestones (learn more about the idea in a previous blog post, and contact me for more details about the current experiment). That’s the future of R&D that I envision.

Conclusion: price control needs big compensations

To conclude, drug price control is an opportunity to refresh an outdated R&D investment model. Success is possible with significant compensatory measures, beyond sugar-coating the NIH. Profits and people should align their incentives, because if they are pitted against each other, both will lose.

Initially appeared on Medium.